-

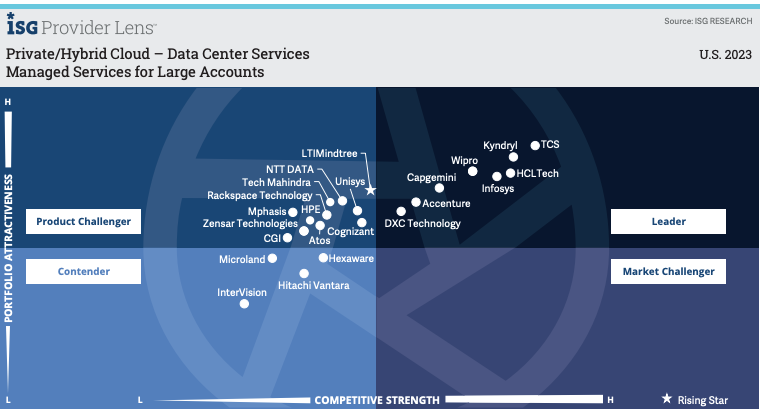

ISG report ranked providers of private cloud and hybrid managed services for large enterprises

-

Leaderboard included companies like Kyndryl, HPE, WiPro, InfoSys, Capgemini and more, though these varied by country

-

Rising Stars included LTIMindtree and Tech Mahindra

The public cloud hyperscalers get a lot of attention, but there’s plenty of activity in the private and hybrid cloud market as well. That’s partly because enterprises, educational institutions and government entities aren’t so sure they can effectively handle public cloud deployments just yet. So, managed deployments in hybrid and private environments seem to be just the ticket. But what are the big names to watch there?

Connecticut-based Information Services Group (ISG) is a tech research and advisory firm. The company recently put out its 2023 Provider Lens report looking at managed services for the private and hybrid cloud market.

One segment of ISG’s report looked at providers which offer managed services for private and hybrid clouds as well as data center infrastructure for mid-market and large enterprises. It defined rising stars as service providers that it believes “have strong potential to move into the Leader quadrant.”

So, who’s on the list? Well, it depends where you look.

The U.S.

According to ISG, the likes of Tata Consultancy Services (TCS), Kyndryl, HCL Technologies, WiPro, InfoSys, Capgemini, Accenture and DXC Technology rank among the leaders in the U.S. data center services market. Plenty of recognizable names populate the challenger tier – think Rackspace, HPE, and Tech Mahindra – but only one earned the designation of Rising Star: LTIMindtree.

Founded in 1996, the India-based company has more than 80,000 employees and a presence in more than 30 countries. It boasts more than $4 billion in revenue from over 700 clients.

The U.K.

The rankings in the U.K. were slightly different than in the U.S., with Accenture, Kyndryl and TCS in pretty much a dead heat. They were followed by Capgemini, HCLTech, WiPro, Computacenter, Infosys, Atos, DXC Technology and Fujitsu.

Here, Tech Mahindra is listed as a rising star.

Founded in 1986 as a joint venture between Mahindra &Mahindra and BT, the company rebranded in 2006. The company has more than 1200 global customers and $6.5 billion in revenue, with a staff of 148,000 and a presence in 90 countries. In 2021, it acquired DigitalOnUs to boost its hybrid cloud and DevOps portfolio.

Elsewhere

A number of companies outside the usual suspects made the leaderboard in other countries covered in the report, including Telstra (Australia), Orange Business (France, Netherlands, the Nordics), Tietoevry (the Nordics), ATEA (the Nordics), T-Systems (Germany), Arvato Systems (Germany), Singtel (Singapore and Malaysia) and Telekom Malaysia (Singepore and Malaysia).

Rising stars in these markets included Logicalis (Australia), LTIMindtree (Netherlands), HCLTech (France), DXC Technology (the Nordics) and TCS (Germany). There was no rising star listed for Singapore and Malaysia.