Quantum computing promises to deliver a whole new level of processing power for the cloud. But Richard Moulds, GM for Amazon Web Services (AWS) quantum computing service Amazon Braket, told Silverlinings the technology “is not something you just put in a rack in a data center.”

Indeed, quantum computing is poised to change the shape of data centers entirely.

What makes quantum computing special?

The term “quantum” gets thrown around a lot these days, so it might be hard to get a sense of what exactly makes quantum computing special. Moulds explained that the technology isn’t just “some next generation computer” but a machine that operates in a “fundamentally different way.”

Putting it very simply, while classical computers rely on switches and logic to process data, quantum computers rely on the interactions between atomic entities – like atoms, electrons and photons – to answer mathematical problems. Don’t worry, we don’t really get it either. But according to Moulds, that makes a quantum computer “almost like an organic machine.”

Today, according to Moulds, quantum computers can’t yet beat a classical computer when it comes to processing, but he said the industry hopes that will change soon, and they’ll be tailored to outperform when it comes to specific workloads.

Moulds put these workloads in three categories: solving problems that have an infinite number of possible outcomes (think routing planes, packages and network packets); helping machine learning come to the right answers quicker; and using quantum computers to simulate quantum problems (for example, how chemical reactions work to formulate better medicines or materials). He added the latter could be among the first quantum computing use cases to come to fruition.

Quantum sensitivity

The thing is, quantum computers are extremely sensitive and require vastly different cooling systems than today’s data centers provide.

“Some of these machines operate at temperatures that are colder than anywhere else in the universe,” Moulds said.

“A quantum computer in the end might be a chip, but it might sit in a room full of physical equipment to get that chip down to the sort of temperatures it needs to be,” he said. “Heat is all about energy and the reason why you want something to be super, super cold, is because you’re quelling all of the energy out of the system, all of the noise out of the system.”

There are also other forms of quantum computers that are comprised of tables full of optical equipment. Instead of being super cold, they’re hypersensitive to vibration, temperature and pressure changes.

"Whether it’s super cold or super fragile, they’re fascinating engineering projects,” Moulds said. “The notion that somehow these could be racked and stacked in a data center right now is a fantasy.”

Today’s machines aren’t even developed to the point that you’d want to put them in a data center. That’s part of the reason AWS launched Braket – to build its own machine and better learn what it will mean to scale quantum infrastructure over time, Moulds added.

AWS is not the only cloud provider experimenting with quantum designs. Google has a quantum data center in Santa Barbara, California, where it is working to build an error-corrected quantum computer. And last month, IBM announced plans to build its first European quantum data center in Germany. The facility is expected to be operational in 2024 and will be IBM’s second such campus. It also has a quantum data center facility in New York state in the U.S.

Quantum market boom

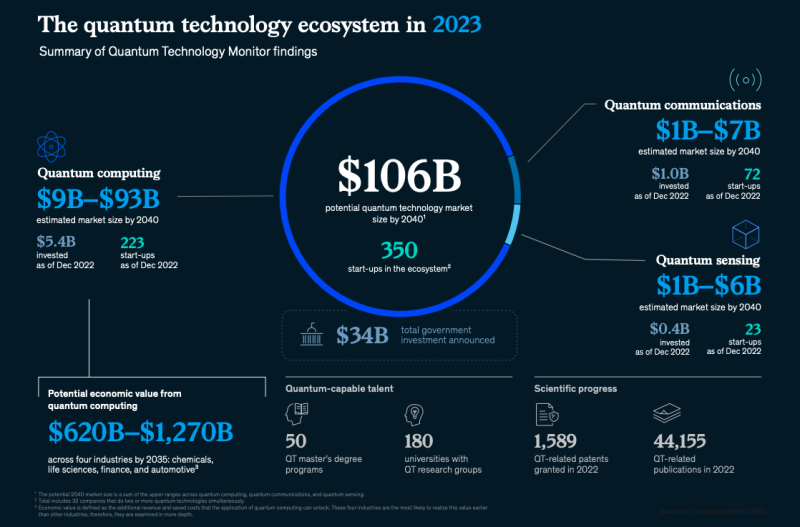

There’s good reason why these tech titans are hustling to develop quantum computing technology. McKinsey & Company has forecast the potential quantum technology market could reach $106 billion by 2040, with quantum computing accounting for between $9 billion and $93 billion of that number. (See image below.)

As of December 2022, the firm said $5.4 billion had already been invested in quantum computing and there were around 223 startups operating in the space. The U.S. led with 72 quantum computing startups, followed by Canada (28), the U.K. (22) and Japan (14). The U.S. also had the largest number of incumbents working in this space, with 9.

Thus far, the only part of the quantum computing value chain that has matured to generate significant revenue is the equipment and components market. The hardware, systems software, application software and services markets remain under development, McKinsey indicated.

Moulds’ comment about medicine and materials development being among the first use cases for quantum computing matched with McKinsey’s findings. “Our updated analysis for 2023 shows that the four industries likely to see the earliest economic impact from quantum computing—automotive, chemicals, financial services, and life sciences— stand to potentially gain up to $1.3 trillion in value by 2035,” the firm’s report stated.