-

Microsoft's Azure growth rate was down year on year in its fiscal Q1 2024, with the company joining Google Cloud in its slide

-

New Street Research analysts took a look at the reason for the growth declines and where things go from here

-

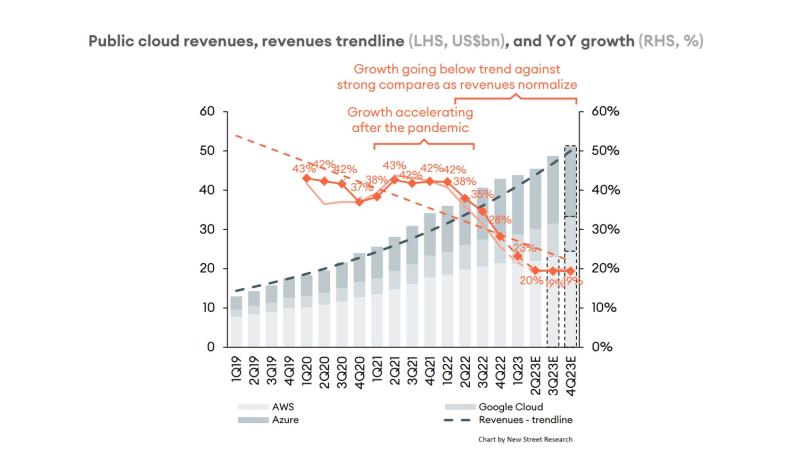

They predicted growth will stabilize for years to come thanks in part to AI and digital transformation efforts

Alphabet’s Google Cloud unit finally fell victim to the cost optimization trend, with its growth rate falling to 22% year on year in Q3. Microsoft Cloud posted revenue of $31.8 billion but its Azure growth rate of 29% was down year on year from 35% in the company’s fiscal Q1 2023 (ended September 30, 2022). Amazon Web Services (AWS) has yet to report its latest earnings, but analysts are expecting a growth rate of around 13%. Has the industry hit rock bottom yet? Or will the slide continue?

Pierre Ferragu’s team at New Street Research seems to think the industry has hit its growth floor.

According to Ferragu, part of the reason for the big growth slide is that cloud spending jumped “well above trend” in the first two years of the Covid-19 pandemic. That meant tough year over year comparisons as spending began to normalize and enterprises looked to optimize their existing deployments.

Looking ahead, Ferragu said New Street expects “optimization to abate while easier compares play out in the next 2 quarters.” Over the longer term, he predicted the growth rate will remain in the 20% to 30% range. That’s thanks in part to continued spending on artificial intelligence and digital transformation initiatives.

This spending was reflected in Microsoft’s FQ1 2024 earnings. CEO Satya Nadella noted on the company’s earnings call that its Azure business benefitted from new AI project starts.

“As you know, AI projects are not just about AI meters. They have lots of other cloud meters as well,” he said. Nadella added that the company’s recent partnership with Oracle has unlocked a number of “new customers who have a significant Oracle estate that have not yet moved to the cloud.” He pointed to the financial services sector as an example of an industry where “there’s a lot of Oracle that still needs to move to the cloud.”

Thus, it seems despite the recent slowdown, the future remains bright for hyperscalers.

“Public Cloud remains a no brainer for the vast majority of use cases, and has plenty of headroom to exceed 10% of IT spending,” Ferragu concluded.

Interested in debating and discussing the challenges of multi-cloud management with your peers? Meet up in Sonoma, Calif., from Dec. 6-7 for our Cloud Executive Summit.