-

HGInsights said that 5% of Azure customers are big spenders compared to 2.3% of AWS customers and .05% of GCP customers.

-

The firm notes that the small spenders ($1,000 per month or less) play a big role in AWS securing its market share leadership.

-

Startups with 10 or fewer employees tended to be much further along in their digital transformation, the firm found.

The big three U.S. cloud providers —Amazon Web Services (AWS), Microsoft Azure and Google Cloud Platform (GCP) —Q2 2023, AWS had a market share of between 32% followed by Azure with 22% and GCP with 11% market share. Together these big three U.S. cloud leaders make up about 65% of the global cloud market.

However, when it comes to the number of big enterprises that spend $100,000 or more per month or more on their cloud computing needs, Azure is the No. 1 player.

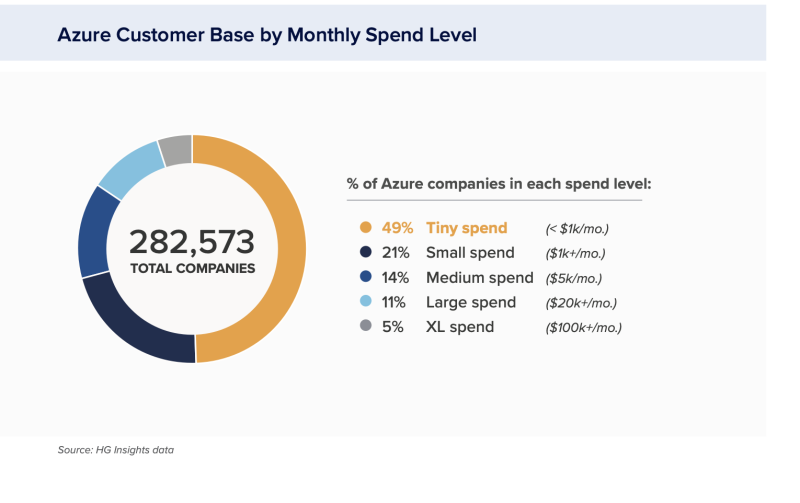

According to HGInsights, which collected data from AWS, GCP and Microsoft Azure enterprise customers and reported separately on each of the big-three cloud providers in April 2022, October 2022 and March 2023, Azure leads AWS and GCP when it comes to big-ticket enterprise customers that spend $100,000 or more per month. HGInsights said that 5% of Azure customers are big spenders compared to 2.3% of AWS customers and .05% of GCP customers.

Nevertheless, all three cloud providers get the majority of their business from small spenders – or companies that spend $1,000 per month or less.

According to HGInsights, a whopping 86.3% of GCP customers fit in the $1,000 per month or less spending category with another 10.9% fall into the $1,000 to $5,000 per month cloud spending group. Likewise, 76.5% of AWS customers are in the $1,000 per month or less spending category with another 6.6% of AWS customers fall into the $1,000 to $5,000 per month group. Meanwhile, just 49% of Azure customers are in the $1,000 per month or less spending category and 21% are in the $1,000 to $5,000 per month group.

HGInsights notes that the small spenders ($1,000 per month or less) play a big role in AWS securing its market share leadership and said that a key part of AWS’ strategy is to win business from small startups early and then grow with them as they scale their businesses.

Interestingly, many of AWS’ and GCP’s small spenders are in the entertainment vertical, which HGInsights describes as media, broadcasting and entertainment. Azure also has a large number of small spenders in that vertical but many of its big-spenders ($100,000 per month or more) fall into the Internet industry category.

Multi-cloud adoption

AWS has a slight lead over GCP and Azure when it comes to the number of cloud customers that are exclusive to AWS. HGInsights said that 85% of AWS customers only use AWS. Of the 15% of AWS customers that use multiple cloud providers, the vast majority (77%) are large enterprises followed by startups (22%). Of those AWS multi-cloud users, 6.4% said they use GCP alongside AWS and 5.5% said they use Azure.

About 84% of GCP cloud customers said they exclusively use GCP and 16% use other providers. Of those multi-cloud customers, 14.9% use AWS in addition to GCP and just 1.5% said they use Azure in addition to GCP.

Meanwhile, 75% of Microsoft Azure customers said that they exclusively use Azure for their cloud computing. Of the 25% of Azure customers that are multi-cloud, the majority (22%) use AWS in addition to Azure and 3% use GCP in addition to Azure. Only 0.1% of Azure customers said they use Oracle. HGInsights noted that Azure and Oracle have an integration agreement that helps support customers with their multi-cloud deployments so Oracle’s percentage may grow over time.

Cloud moves

HGInsights also crunched its data on enterprise cloud customers to determine how far along each cloud providers’ customers are in their digital transformation.

For example, it found that startups with 10 or fewer employees tended to be much further along in their digital transformation with the majority of their infrastructure spend going to the cloud providers and almost none of it going to data centers. GCP had the highest percentage (91.2%) of its startup customers classified as cloud native compared to AWS, which has 88.2% of its startup customers categorized as cloud native. Azure has 69% of its startup customers described as cloud native.

For these stats on cloud customers, HGInsights collected information on roughly 282,000 Azure customers, 1.7 million Microsoft Office customers, 760,000 GCP customers and 1.45 million AWS customers.