-

Vendors are racing to combine cloud, observability, automation, AI and security into new “smart cloud” portfolios

-

Self-healing, self-optimizing, self-defending, self-aware — self-propelled! — smart cloud networks are coming

-

The challenge of working out how to sell smart cloud has sent some vendor’s marketing departments into a fugue state

I’ve had a Road to Damascus-type epiphany about the next-gen communications market. Like everyone else in our industry, I’m blizzarded on a daily basis with press releases about a kaleidoscopic array of cloud-related buzzwords, acronyms and marketing-speak.

It’s all terribly confusing — until you realize that as an industry, we’re making the classic mistake of getting lost in the details (a forest for the trees thing).

Pull all the way back from the minutiae to look at the big picture — the view from the satellite, if you will — and a common theme emerges that makes sense of everything.

And it’s this: The world’s biggest vendors are locked in a race to combine cloud, observability, automation, AI and security into a new networking model that will precipitate the next great global revolution in the communications industry.

When fully integrated, these technologies will enable the creation of smart cloud networks that can run themselves without human involvement and do so less expensively — but also more efficiently, responsively and securely than anything that exists today.

To stick with the Biblical metaphors, we’re talking about finally achieving the Holy Grail of communications networking (and not in the Monty Python sense). This is a level of paradigm shift — like packet data, or the cloud itself — that comes along only once every couple of decades and changes everything, everywhere, all at once.

This isn’t just about new technology. The recent bursts of M&A activity suddenly make a lot more sense when viewed through the prism of vendors trying to construct smart cloud portfolios.

Smart cloud is why Cisco is buying Splunk, HPE is buying Juniper and Broadcom bought VMware. It’s why Ericsson bought Vonage and why Nokia partnered with Red Hat. More deals are inbound.

My name is… chka-chka

One reason why there is so much confusion in the comms market currently is that there isn’t an established term to describe the transition.

I’ve picked “smart cloud” because it’s vastly superior to any of the names that vendors have come up with and, frankly, when you are defining a new market category its best to keep things simple for the folks in the back of the industry bus. (Also, smart cloud has a nice resonance with a related global mega-trend: smart cities, with which it shares some technology DNA).

Making smart cloud a reality is a huge undertaking. All of the world’s leading communications vendors are competing to complete the puzzle through a mix of M&A and R&D, but no one yet has all of the requisite pieces. And even when they do, integrating the technologies required to build smart cloud is an even bigger challenge — and an essential one. Only through seamless integration can the benefits of smart cloud be unlocked. Without it the value of the different technologies — usually acquired from different sources — remains stove piped.

This is where the big guns of the communications industry, the incumbent vendors, are uniquely advantaged versus hyperscalers and start-ups, with the resources and experience to perform the integration work.

Eliminating the Romulan cloaking device

All of that work will be worth it.

“The two big complaints from enterprise customers [with multi-cloud environments] today are ‘I can’t control the performance of my applications,’ and ‘I don’t know where my data is," Andrew Coward, GM, Software Networking at IBM (NYSE: IBM) and chief architect of IBM’s smart cloud vision, told us.

“If they outsource data and applications, they need to put control structure back in to be comfortable with that,” Coward said.

IBM is providing that control structure through its Hybrid Cloud Mesh product, featuring technology acquired through a slew of acquisitions it has made over the last two years.

By eliminating the Romulan cloaking device that multi-cloud throws over enterprise traffic, Hybrid Cloud Mesh allows enterprises to improve network performance by automatically steering traffic based on the performance of individual cloud networks but, even more importantly, it also handles application automation functions — including application modernization and placement.

It can also help enterprises control their spending on cloud egress fees, which can represent up to a third of the cost of cloud infrastructure, according to IBM.

New model army

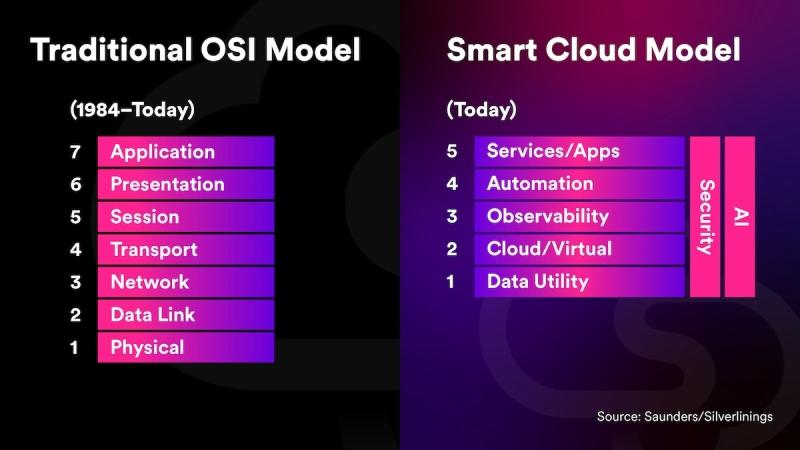

Smart cloud networks use a new architecture that’s markedly different to the OSI model which has been the prevailing reference model for network design since the 1980’s. The diagram below provides a side-by-side comparison.

Layer 1 in the smart cloud model is “Data Utility," which provides a place to consolidate all of the more ho-hum network plumbing, including things like the physical plant (racks, cabling, power, cooling), but also switched packet data (carried on fiber, free space optics, radio access networks and other foundational broadband networks).

In the new smart cloud model, data behaves like, and is managed as, a utility, like electricity, or water. And while data itself is a vital component of the smart cloud, it’s not one that smart cloud network architects will have to spend much time on in the future.

High-capacity, ubiquitous, reliable, global data connectivity is the future of the data utility, tracking the same cost and availability paths that voice followed before it.

Layer 2 is Cloud or Virtual networks, which provide the infrastructure over which all the cool smart stuff happens.

Layer 3 is Observability, which used to be called network monitoring and management, but had its name changed by vendor marketing departments because they thought observability sounded cooler (and they could charge more for it). To be fair to the observability peeps, it now encompasses both network traffic and application performance — but yeah, same thing, new name.

Layer 4 is Automation. Nothing new here, either — automation has been around forever. (You can park orchestration in layer 4, too, if you feel like it. Nobody will mind). It’s what happens when layer 2, 3 and 4 of the smart cloud model are tightly integrated using APIs that the smart magic happens, providing unprecedented levels of functionality, visibility and responsiveness for services and applications running over cloud infrastructure.

Speaking of which…

Layer 5 is Applications and Services but could also be called “Content,” because that’s the unifying quality underlying both, and also where the value lies in the smart cloud model (far, far away from layer 1, where the value of data has becoming commoditized, just as voice did after the arrival of VoIP).

But wait, there’s more…

This is where the smart cloud network model takes a 90 degree turn away from the OSI model, with the addition of pillars. Both describe network functions that permeate every layer of the smart cloud model.

Pillar 1 is security. The OSI model treats security as an application, sitting on top of the stack, like a hardhat, or a Kevlar helmet. But that’s not how it’s deployed in today’s cloud environments. Rather, security is now applied holistically in every layer of the network (data, applications, services, and the associated hardware and software infrastructure of the cloud). Hence the pillar. And because I’ve extended the Security Pillar in the smart cloud model all the way down through the data utility layer, it also encompasses physical plant security (men with truncheons, razor wire, killbots, etc.)

Pillar 2 is AI. The big one. Artificial intelligence is sweeping through the entirety of cloud communications networks, but it’s currently been used on an app-by-app, platform-by-platform, or device-by-device basis where it improves performance of quality of service, energy usage, traffic optimization and other functions, ordinarily in accordance with predetermined policies and parameters.

Even in this limited role, service providers have so far been leery to implement AI in “closed loop” configuration where it operates independent of human oversight, for example by defining those policies and then enforcing them. And communications service providers (CSPs) are even further away from trusting AI enough to deploy it in the role of a preternaturally smart cybernated godhead with dominion over the entire cloud ecosystem.

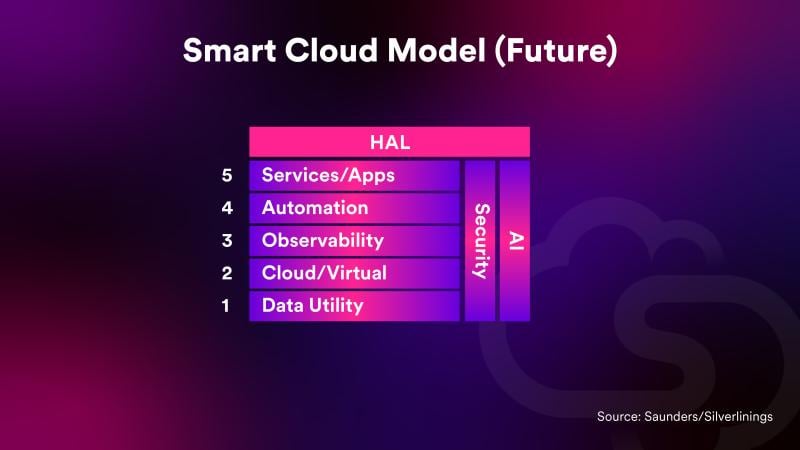

So, the diagram above shows the state of the art of AI, now, but I’ve also added an updated extra model below 👇 which shows what’s coming: the communications world of the future where AI sub-agents and programs live in each layer of the model, but an omnipotent AI entity sits over everything, tasked with independently overseeing the entire communications ecosystem — making moves, adds and changes as it sees fit.

I call this top-level AI system HAL, and if you don’t get that reference, it’s probably a bad idea for you to be involved in anything related to AI. At all.

Shake your market-maker

Smart cloud promises to be incredibly disruptive to the comms industry. That’s because the capabilities that smart cloud delivers aren’t restricted to just the telco, enterprise or vertical industries; they’re ubiquitous, blurring the borders between these sectors, allowing companies to reinvent themselves and build beachheads into new markets.

Enterprises and vertical industries, for example, can disintermediate service providers by building their own private smart cloud networks. Service providers can use smart cloud to defend their position against hyperscalers — and deliver service assurance via iron-clad SLAs for mission-critical services and applications, even when they run in opaque multi-cloud environments. And hyperscalers can use smart cloud to finally persuade telcos to put their core operations in the public cloud.

All of this is forcing incumbent vendors to rethink not only their product portfolios, but also how they are organized internally. Most vendors still divide their operations — and sales organizations, and marketing teams — into two distinct camps: enterprise and telco and they really don’t like each other. The only people taking a holistic view of the industry are higher up in “corporate.” (Suit alert! Lots of talky talky and golf handicaps — not a lot of actual doey, doey).

Smarty pants

The new world of smart cloud demands a different unified business structure and most vendors don’t have a clue what it should look like but there are two exceptions:

Ciena

Ciena (NYSE: CIEN) is a notable exception here, astutely timing the market by spinning out Blue Planet into its own automation business unit back in 2019 — years ahead of its competitors.

Ericsson

At its media day in London this month, Ericsson laid out its own smart cloud model (currently unnamed), which comprises a 5G network layer sitting under a cloud infrastructure supporting generative AI-based automation. Its smart cloud approach is differentiated by the open API capabilities that it obtained through its acquisition of Vonage, which allow developers and enterprises to build revenue-generating cloud-native applications. Ericsson is tilting toward the future of communications with a well thought out architecture. The company has recently been rewarded with several big customer wins, including Verizon. Impressive stuff.

F5

F5 (NASDAQ: FFIV) also got its act together early on smart cloud, which it sells under its entirely acceptably named Distributed Cloud Services portfolio (which does what it says on the label).

All of the incumbent telecom vendors (Ciena/Blue Planet, Cisco, Ericsson, F5, HPE, IBM, Juniper, Huawei, Microsoft, Nokia, RedHat, VMware) are now developing smart cloud strategies, but there are three that have been especially active over the last year.

IBM

IBM (NYSE: IBM) and Andrew Coward, are smart cloud thought leaders. Under Coward’s leadership the company has acquired more than two dozen companies to make its smart cloud strategy a virtual reality. Oddly, IBM’s marketing strategists decided to spend 2023 not telling anyone about its vision. (Shhhh, it’s a secret — tell no one!) Expect more detail from IBM at MWC 24 in Barcelona. (Maybe. Depends how they feel).

Cisco

Cisco: IBM’s marketing hesitancy ceded the smart cloud first-mover high ground to Cisco Systems Inc. (NASDAQ: CSCO), which filled the void left by IBM with its own strategy an altogether surprising turn of events given that for the last decade Cisco has been more like a Cisco tribute band (tribute brand?) than the company that lit up the communications world at the start of the century.

Yet, here it is, having undeniably grasped the scale of the smart cloud opportunity and spending bigly to put together a portfolio to deliver it, including AppDynamics (full-stack application performance management, IT analytics), Splunk (analytics, app management, compliance, security), and ThousandEyes (network infrastructure monitoring, app troubleshooting and delivery). Kudos, second-generation Ciscoans.

Cisco has given its smart cloud strategy a "does what it says on the label" name: Cisco Networking Cloud and the portfolio sits under Jonathan Davidson, EVP and GM for Cisco Networking.

Huawei

Huawei, the largest telecom solution vendor in the world, and the largest spender on R&D by miles, parks its smart cloud solutions under an overall banner of intelligent communications. Within that broad but astutely named category it has a range of smart cloud-related products, including the Enterprise Intelligence (EI) platform, Intelligent Cloud-Network, and Core Network Autonomous Driving Network (ADN).

Huawei is also the only company whose smart cloud solutions that I have inspected in person – in Hong Kong, Hungary and Tianjin. Expect Huawei to continue to light up smart cloud networks throughout 2024, well ahead of the rest of the industry, including in countries that more parochial US vendors would struggle to point out on a map.

For whom the bot tolls

The first time I predicted the advent of fully autonomous networks was all the way back in 2017.

Since then three things have happened that bring zero hour much closer — within reaching distance. First, we got rid of spring-operated network functions virtualization technology and replaced it with cloud.

Second, AI came of age. At this point, the technology is in place to make full autonomy possible, but first, the tech must be fully integrated and, second, vendors must persuade service providers, enterprises and vertical industries that they can trust HAL with the keys to their kingdoms.

That last obstacle is non-trivial. Companies are right to be hesitant. At a business level, autonomous, closed loop AI automation on smart cloud is going to make everything better on communications networks, but if you are personally involved in deploying, designing, or selling next-gen cloud networks you should watch your back, puny mortal.

This article was updated on Feb. 15, 2024, at 11:34 am EST, and on March 19, 2024, at 10:50 am EDT.

Read more Op-Eds by Stephen M Saunders MBE here.