Who has time to sit on multiple hour-long earnings calls? Certainly not our cloud warriors. So, we compiled some key takeaways from Q4 2022 earnings season to offer a snapshot of where things stand in the cloud market.

Long story short, revenue is up but growth is down and the big guys kept getting bigger.

Here, we’re looking at results for what calendar Q4 2022, which aligned with Microsoft’s fiscal 2023 Q2. And we put the data in charts just for funsies.

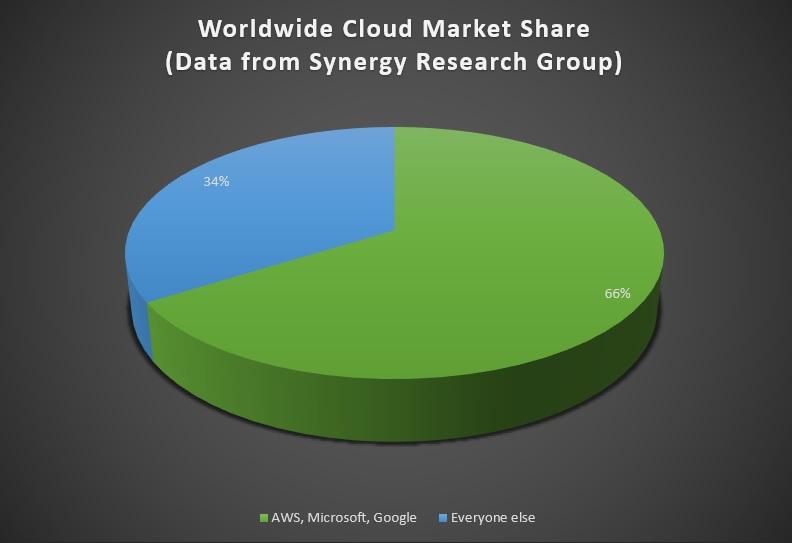

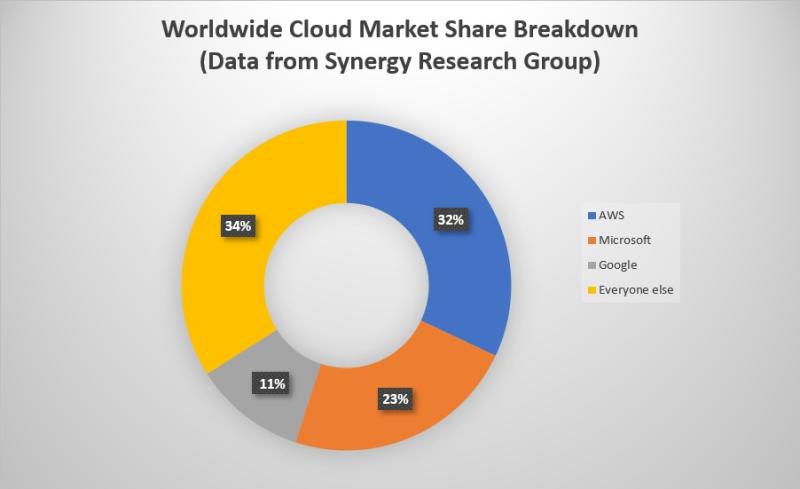

Cloud market share

It’s perhaps no surprise that the big three cloud providers made up the bulk of the worldwide cloud market again in Q4, but seeing that share depicted in a chart makes the information register on a whole new level.

Together, Amazon Web Services (AWS), Microsoft and Google account for two-thirds of the global cloud market, with competitors including Alibaba, IBM, Salesforce, Tencent and Oracle duking it out for business in the remaining third. The big three’s share was up from 63% in Q4 2022, according to Synergy Research Group.

AWS continued to lead the pack in Q4, though John Dinsdale of Synergy Research Group noted Microsoft managed to increase its share year on year from 21% to 23%. Google also made gains over the past year, going from just below 10% in Q4 2021 to 11% in the recent quarter.

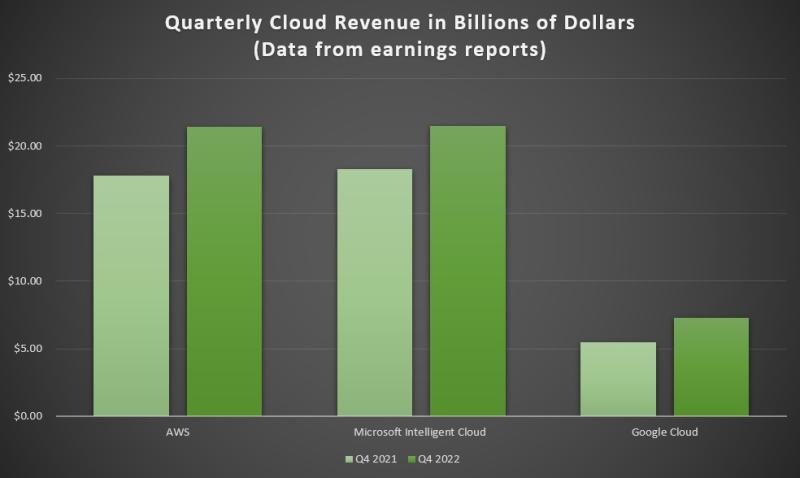

Revenue growth

All three of the top cloud providers made substantial revenue gains year on year in Q4 2022.

In terms of what exactly customers are buying, Dinsdale told Silverlinings infrastructure-as-a-service (IaaS) remains the largest segment in the market but platform-as-a-service (PaaS) is “growing more quickly and narrowing the gap.” He added that within PaaS, “database and analytics type services are the fastest growing.”

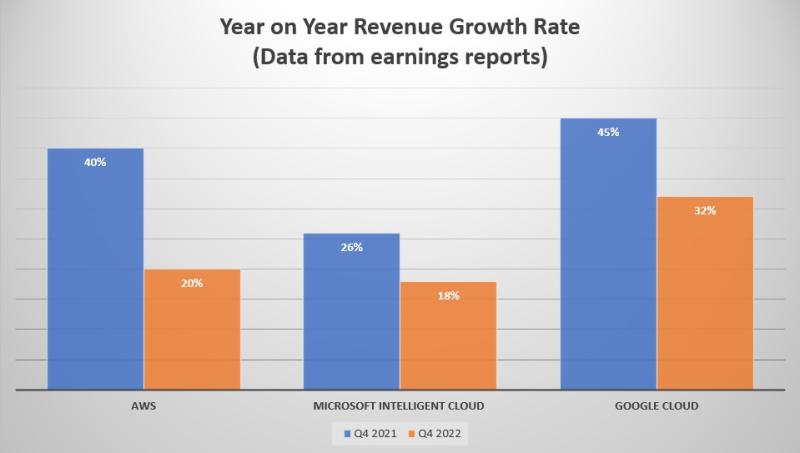

The revenue gains, however, disguised a slowdown in year over year growth rates, which fell across the board for the big three.

Despite the revenue growth decline across the board, Synergy Research Group found the worldwide cloud market grew by a whopping $47 billion compared to 2021, though this figure fell slightly short of the $49 billion in year on year growth achieved in 2021 compared to 2022.

The analyst firm concluded that “as economies improve and the foreign exchange market stabilizes, Synergy forecasts that the worldwide cloud market will continue to grow strongly over the coming years.”