-

Smart cloud strategy opens up the network to application developers

-

Enhanced AI increases CSP trust in machine learning models

-

“5G everywhere” provides the foundation of Ericsson’s new architecture

Ericsson used its pre-MWC media day at London’s County Hall on the Thames last week to reveal a landmark new network architecture designed to unlock the value of cloud for communications service providers.

It was the most significant announcement at an event that included several other key technology launches, notably around AI. Ericsson backed up the messaging around each new capability with big-name customer testimonials — an essential proof point in the current unsteady comms market.

Even by Ericsson’s standards (it’s known for being rather good at this sort of thing) this year’s pre-MWC media day was exceptional. Previous events have gone through the company’s technology announcements sequentially, but this year the focus from the outset was on fitting everything together into a cohesive blueprint that service providers can apply to de-risk and accelerate profitable cloud deployments.

In doing so, Ericsson joins the ranks of other incumbent vendors – including Cisco, Huawei and IBM – in announcing so-called (by me) Smart Cloud strategies.

Ericsson forgot to give its grand strategy a name at its event, so I’ve done that for them.

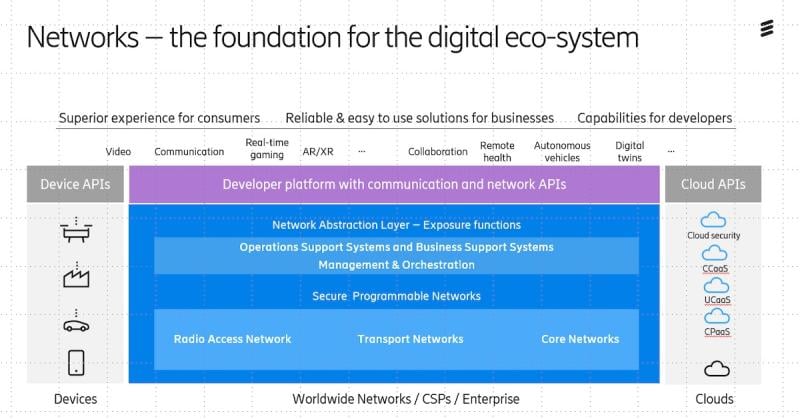

Introducing — drumroll! — the Ericsson Open Programmable Cloud Ecosystem (OPCE). (See image below.)

As the name infers, Ericsson’s approach contains a key differentiator versus those of its competitors: using open APIs to allow the developer community globally to access network services and capabilities on cloud networks. Its goal is to unlock the network and enable CSPs to win a share of the vastly profitable application market which until now has been the remit of the OTT and hyperscaler players.

The strategy relies on the API capabilities that Ericsson acquired when it bought Vonage in 2022. That deal came in for heavy criticism at the time for being too expensive, but Vonage’s API capabilities have recently won significant partnership deals for Ericsson with a who’s who of leading global service providers – including AT&T, AWS, Deutsch Telekom and Verizon.

Will it work in the long term? It’s too early to say. Service providers have not historically been adept at developing or monetizing applications, but they need to do something to defend their territory from incursions by both hyperscalers, and enterprises and vertical industries that are end-running them by building their own private networks.

This is visionary stuff from Ericsson and its CTO, Erik Ekudden, and exactly what Ericsson should be doing to reinvent itself above and beyond its radio heritage.

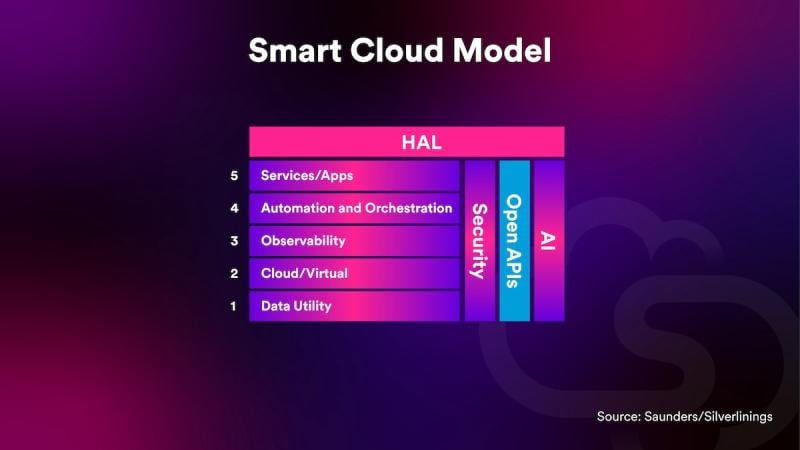

Ericsson’s OPCE approach matches up seamlessly with Silverlinings own vendor-neutral Smart Cloud industry model, which we published a couple of week ago (Ed. Note: that’s a relief).

The OPCE architecture is completely cloud-native, with its foundation layer running on standalone 5G (5G SA), which translates to layer 2 of the Silverlinings model. It doesn’t encompass optical transport, Ericsson says; that sits below the 5G cloud-native infrastructure in what Silverlinings categorizes as the Data Utility layer (layer 1).

Where OPCE and Silverlinings’ models differ is in the addition of the new open API capabilities. We’ve added them into our model below, highlighting them in “Ericsson blue.”

Because the API capabilities are applied throughout the cloud ecosystem they get their own pillar, rather than a horizontal row. We will continue to update the Silverlinings Smart Cloud model based on further industry developments. (For now, congrats to Ericsson on extending the industry’s understanding of how 21st Century Cloud infrastructure should be designed).

Trust issues

Nestled within a stack of other product announcements and enhancements made at the media event was an important AI development.

Ericsson’s explainable artificial intelligence (XAI) software, part of its Cognitive Software portfolio, provides visibility into the rationale behind machine learning model’s decision-making on live networks. Currently, one of CSPs biggest bugbears about AI engines is that they sit around making unintelligible beep-boop noises and recommending moves, adds and changes for reasons that are unfathomable to the hoomans who still run the network. This is anathema to the telco philosophy of “visibility and accountability in everything.”

With XAI, Ericsson says CSPs will have full “explainability” (Ed. note: made up word alert) on actions recommended by the AI-powered solution, identifying the root causes of events affecting network performance and end-user experience.

By lifting the veil on AI’s thought processes, XAI helps increase CSP’s trust in the technology. It’s one of the most significant AI announcements made by any company recently and speaks volumes to Ericsson’s clear conception of its telco customers’ pain points around new tech solutions.

Up-levelling CSPs’ faith in AI also inches our industry closer to the adoption of HAL – a high-level autonomous AI overlord that oversees the entire communications ecosystem without human involvement, at all (see the Smart Cloud model).

Nokia goes its own

While Ericsson and other mega-vendors are all rolling out holistic smart cloud platforms, portfolios and architectures, Nokia is going in the opposite direction, focusing on selling as many point products as possible, as quickly as possible, while also reducing costs.

The Finish vendor undertook a major restructuring at the end of last year to support its new strategy, granting each of its four business units operational autonomy, and providing each with a dedicated sales team. Industry skeptics have pointed out that subdividing the business might also make Nokia easier to break up and sell in pieces if its fortunes continue to wane.

Follow our coverage of Mobile World Congress 2024 in our dedicated channel here.